CUSHMAN & WAKEFILED FORTON: RISING INTEREST RATES CAUSE UNCERTAINTY ON THE INVESTMENT MARKET

Rising interest rates cause uncertainty on the real estate investment market in Bulgaria. Although investors remain focused on attractive properties with stable yields, low visibility ahead is likely to result in subdued investment activity over the coming winter months. This is the main conclusion of the Cushman & Wakefield Forton review of the real estate investment market in the first nine months of 2023.

“The uncertain economic environment and rising lending rates prompt caution among investors. We observe heightened interest towards defensive assets that preserve value and generate stable yields. Currently, many investors view hotel and retail properties as such and increasingly so investment grade residential properties. Meanwhile, interest in offices is receding. Perhaps, excluding the very-high-end office assets,” comments Yavor Kostov, managing partner at Cushman & Wakefield Forton.

INVESTORS SEEK ASSETS THAT WOULD PRESERVE THE VALUE OF THEIR MONEY AMIDST CONTINUED INFLATION

Data from international real estate investment markets shows sharp year-to-date declines across all segments. The numbers for Bulgaria, from Cushman & Wakefield Forton, indicate an investment volume of EUR 110 million over the same period, excluding acquisitions of development land. A notable first in this period was a block deal for yield-generating residential properties.

At present, the main trend in Europe and respectively in our region, is the continued rise of interest rates which pushes yields sought after by investors higher. Cushman & Wakefield forecast that the upward movement would slow down and reverse in the second half of 2024. Accordingly, analysts expect this to be a catalyst for positive developments in real estate investment and to unlock a new upward cycle on the market that would be visible towards the start of 2025.

RETAIL SPACE

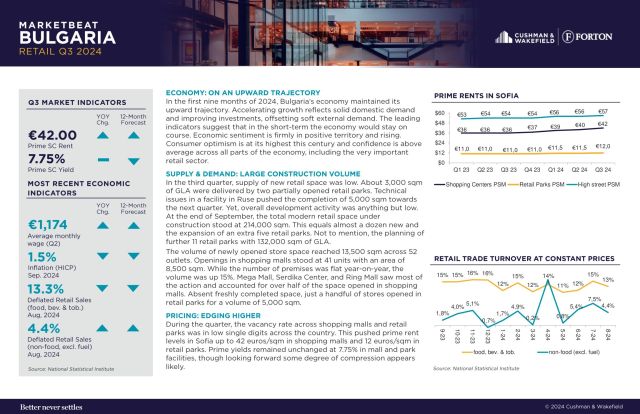

Retail parks remained the main driver of the market for modern retail space over the past quarter. Four new retail parks with combined GLA of 70,000 sqm opened for business during the summer months. As a result, the total stock of retail parks reached 460,000 sqm, which was more than half the stock of shopping malls in the country.

“Despite recent significant investments in retail parks, market saturation in Bulgaria is the lowest in Central and Eastern Europe at 56 sqm per 1,000 inhabitants. Serbia, with 60 sqm, and Romania with 85 sqm, are the two countries immediately ahead of us. In Czechia and Hungary retail park saturation is three times higher.,” says Georgi Muhovski, deputy manager Retail Space at Cushman & Wakefield Forton.

In his words, discounters and modern fashion retailers were most active in their efforts to position and benefit from the increasing penetration of retail parks.

RETAIL PARKS DRIVE THE MARKET, BUT SATURATION IN BULGARIA IS FAR FROM THAT IN CENTRAL AND EAST EUROPE PEERS

The consulting firm notes a relatively strong quarter in terms of newly leased space, again thanks to retail park. Over 80% of deals reflecting dynamics in the latter segment, with the rest being driven mostly by shopping malls. The share of vacant space remained roughly unchanged over the period.

“We expect solid leasing activity at least until the end of the year. Four more retail parks are readying to open in the last quarter of 2023. This would catalyze activity characteristic for the holiday season and would provide an additional impulse to a typically strong period for retailers,” adds Georgi Muhovski.

Cushman & Wakefield Forton report stable rent levels with some upward potential. In Sofia’s shopping malls asking rents stood unchanged at 36 euro/sqm, while prime yields edged up to 7.75%.

OFFICE SPACE

The market for modern office space in the capital saw moderate activity in the third quarter with some 38,690 sqm leased. This was slightly ahead of the average third quarter volume in the previous five years and 54% higher compared to the same quarter of 2022. Nevertheless, the absorption rate was relatively low and the number of viewings prior to each deal were many. Relocations and renewals continued to set the tone with expansions amounting to not more than 20% of total volume.

“Hybrid work practices remain prevalent, particularly among IT and BPO players. In the same time, economic slowdown is causing some cooling in these industries. This prompts reassessment of the office concepts in use, more flexibility and greater focus on serviced and shared offices which are becoming an increasingly important factor,” comments Yoanna Dimitrova, deputy manager Office Space at Cushman & Wakefield Forton.

“We note strong interest from corporate clients in shared office space and the opening of new such facilities in existing office buildings. Also, while earlier we observed openings of classic coworking facilities, targeting digital nomads and freelancers, in the central districts of Sofia, lately there has been growing demand for serviced offices within large office projects. Such spaces are particularly sought for by small but rapidly growing companies or larger corporate clients aiming to accommodate specific teams,” adds Yoanna Dimitrova.

By the end of the third quarter, there was some 64,000 sqm of flexible office space in Sofia, including coworking and shared office facilities, within large office buildings. An additional 9,000 sqm were in preparation and would launch next year.

Due to the subdued state of the market, completion of new office buildings was weak and many projects on hold for better times. During the third quarter, a single small project opened for business and the volume of office space under construction remained under 200,000 sqm.

Lack of new supply keeps the vacancy rate in Sofia at about 16% with negligible ups and downs each quarter. Should demand fail to grow, chances are that the vacancy rate would rise next year, as new projects come online. Higher vacancy would likely affect mostly older buildings, according to Cushman & Wakefield Forton.

During the quarter rent levels continued to creep up. In the central business district of Sofia prime rents reached 16.5 euro/sqm. Class A office space along the main boulevards was typically rented out for 13 to 15 euro/sqm.

LIGHT INDUSTRIAL AND WAREHOUSE SPACE

Supply of light industrial and warehouse space is Sofia remained limited during the last quarter. Demand was also weak during the period, being driven chiefly by pharmaceutical and industrial technology tenants. Yet, this slowdown was likely a temporary blip to be followed by significant rise in activity, according to experts at Cushman & Wakefield Forton.

“The good news is that construction in the segment continues full steam ahead. The volume of light industrial and warehouse space under construction increased by 15% q/q to over 330,000 sqm. At least five of the largest retailers in the country, of both food and non-food products, were constructing new or enlarging existing warehouses. Roughly ten projects would be completed either by the end of this or soon after the start of next year. Electricity plays an important role in the assessment of variable costs of tenants of industrial space. An increasing number of market players adapt to the new conditions and invest in energy saving solutions, photovoltaic installations for own use and systems for generation of renewable power that could be sold on the open market,” says Zhoro Angelov, manager Industrial and Logistics Space at Cushman & Wakefield Forton.

Rent indexation provided a mild upward lift during the quarter. Rents crept up to 5.30 euro/sqm for facilities over 10,000 sqm and up to 5.70 euro/sqm at smaller places. Most likely the upward trend would continue forward. This also applies to the continued rise of yields, due to climbing lending rates. In the third quarter, prime yields reached 7.5%, note Cushman & Wakefield Forton.

RELATED INSIGHTS

CAN’T FIND WHAT YOU’RE LOOKING FOR?

Get in touch with one of our professionals.