VITOSHA BLVD RANKS 47TH AMONG THE MOST EXPENSIVE MAIN STREETS IN EUROPE

SMOOTH RECOVERY OF RENTAL LEVELS IN SOFIA

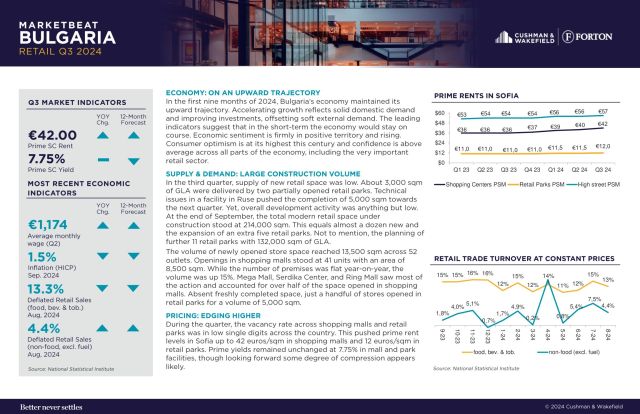

Vitosha Blvd. in Sofia ranks 47th among 53 main streets across Europe in terms of rental levels. The average monthly rent for a 100 sqm shop on the popular central destination is slight above EUR 50/sqm, down 10% compared to 2019 levels of EUR 56/sqm. The decline is a result of the Covid-19 pandemic, with a gradual recovery and return to previous rental rates since the beginning of this year. The ranking is a part of the traditional Main Streets across the World survey, conducted by consultancy company Cushman & Wakefield. The figures for the Bulgarian market are provided by Forton, alliance partner of Cushman & Wakefield.

“Although rents of retail space in the center of Sofia were affected by the pandemic, the trend is towards a smooth increase and return to the 2019 levels” said Krasimir Petrov, Property and Asset Manager at Cushman & Wakefield Forton.

“Vitosha Blvd. continues to attract mostly tenants from the pubs & restaurants segment. The transformation into a pedestrian zone years ago, high rental levels and the shift of the retailers’ focus towards shopping centers and retail parks have gradually contributed to the current appearance of the main street”, he added.

He said that although most of the shops on the high street are of a flagship type, there is an increasing focus on their economic performance. The entry of new cafes and restaurants on the boulevard is also limited, as the buildings there are mainly residential and, in many cases, condominiums refuse to change the use of ground-floor space to restaurants.

Among the other Balkan capitals, Belgrade with Kneza Mihaila, which is in 42nd position on the Old Continent, with rental levels of 82 euro/sqm, and Zagreb with Ilica Street with an average rent of 73 euro/sqm stand out. In Bucharest, Calea Victoriei ranks 46th with a monthly rent of EUR 53/sqm.

The most expensive retail location in Europe is now Via Montenapoleone in Milan with EUR 1,212/sqm monthly rent. It is followed by New Bond Street in London with a monthly rent of EUR 1,195/sqm. The third position in Europe is occupied by Via Condotti in Rome with EUR 1,034/sqm per month. Paris’ Avenue des Champs Elylees drops out of the Top 3 and takes 4th place with EUR 922/sqm per month.

NEW YORK, HONG KONG AND MILAN LEAD THE WORLD RANKING

Globally, the most expensive street is again Fifth Avenue in New York, with a rent of EUR 1,756/sqm. Fifth Avenue is also up 14% from before the Covid-19 pandemic. In second position, despite a 41% drop from 2019, is Tsim Sha Tsui in Hong Kong. In third place globally is Europe’s champion, Milan’s Via Montenapoleone.

Olso’s Nedra Slottsgate saw the biggest jump in the rankings, climbing from 27th to 22nd place, while Warsaw’s Nowy Swiat saw the biggest drop – from 32nd to 36th position.

The recovery trend is valid not only for Bulgaria, but also internationally and rental levels are gradually returning to the indicators of 2019. At the peak Covid-19, prices in EMEA dropped by 11% on average, although they varied significantly depending on the severity of ongoing closures. Ireland, the UK, Spain and France experienced significant impacts, with rents falling by up to 28% on average. Meanwhile, changes were minimal in parts of Eastern Europe, such as Slovakia and Slovenia.

Prime rents in the region have recovered to 8% below pre-pandemic levels and the EU region recorded retail sales volumes in early 2022 that were 4.1% higher than levels at the onset of Covid-19. However, the recovery has and will continue to be challenged by inflation, which is having a serious impact on consumer demand.

Despite the challenging short-term economic outlook, Cushman & Wakefield is seeing a wave of new entrants exploring physical retail. Over the past 18 months, 75% of retail transactions have been new leases, meaning retailers are again appreciating the importance of physical stores.

“Many brands are taking a long-term view a striving to secure the best opportunities to adapt to increasingly demanding customers. With further investments aimed at making the in-store visit an experience, as well as advances in omnichannel approaches, we are confident in the sector’s resilience, particularly in the luxury segment and in key global destination cities,’’ says Robert Travers. Head of retail for Europe, Middle East and Africa at Cushman & Wakefield.

RELATED INSIGHTS

CAN’T FIND WHAT YOU’RE LOOKING FOR?

Get in touch with one of our professionals.