BULGARIA Marketbeat Industrial – Q2 2024

ECONOMY: Decent tempo and outlook

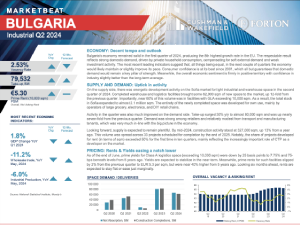

Bulgaria’s economy remained solid in the first quarter of 2024, producing the 8th highest growth rate in the EU. The respectable result reflects strong domestic demand, driven by private household consumption, compensating for soft external demand and weak investment activity. The most recent leading indicators suggest that, all things being equal, in the next couple of quarters the economy would likely maintain or slightly improve its pace. Consumer confidence is at its best since 2001, which all but guarantees that domestic demand would remain a key pillar of strength. Meanwhile, the overall economic sentiment is firmly in positive territory with confidence in industry slightly better than the long-term average.

SUPPLY AND DEMAND: Uptick in activity

On the supply side, there was energetic development activity on the Sofia market for light industrial and warehouse space in the second quarter of 2024. Completed warehouse and logistics facilities brought some 62,000 sqm of new space to the market, up 12-fold from the previous quarter. Importantly, near 60% of this volume was in facilities with GLA exceeding 10,000 sqm. As a result, the total stock in Sofia expanded to almost 2.1 million sqm. The entirety of the newly completed space was developed for own use, mainly by operators of large grocery, electronics, and DIY retail chains.

Activity in the quarter was also much improved on the demand side. Take-up surged 30% y/y to almost 80,000 sqm and was up nearly seven-fold from the previous quarter. Demand was strong among retailers and relatively modest from transport and manufacturing tenants, which was very much in-line with the big picture in the economy.

Looking forward, supply is expected to remain plentiful. By mid-2024, construction activity stood at 327,000 sqm, up 13% from a year ago. This volume was spread across 33 projects scheduled for completion by the end of 2025. Notably, the share of projects developed for rent (in terms of sqm) exceeded 50% for the first time in ten quarters, mainly reflecting the increasingly important role of CTP as a developer on the market.

PRICING: Rents & Yields easing a notch lower

As of the end of June, prime yields for Class A logistics space (exceeding 10,000 sqm) were down by 25 basis points to 7.75% and 75-bps beneath levels from 5 years ago. Yields are expected to stabilize in the near-term. Meanwhile, prime rents for such facilities slipped by 2% from the previous quarter to EUR 5.3 per sqm, but were near 40% higher from 5 years ago. Looking six months ahead, rents are expected to stay flat or ease just marginally.