Sustained office vacancy levels and stable retail market

The share of vacant office space in Sofia has remained stable and even marked a symbolic decline to 16.4% by the beginning of 2022. At the same time, the segment registered one of its strongest first quarters in the last 5 years in terms of leased space – 44,000 sqm. This is according to the report by the consulting company Cushman & Wakefield Forton.

The market data shows that despite the impressive volume of newly leased space, net absorption remains modest at the moment – 8,600 sqm. The market continues to be driven mainly by relocations and contract renewals rather than office space expansions. Thus, the retention of vacancy levels can be explained by the lack of new completions in Q1 2022. Office development activity is also at low levels, with just under 200,000 sqm under construction in Sofia.

“The total volume of leased office space in Q1 2022 exceeded almost three times those at the beginning of the previous year 2021, when the volume of newly leased offices was only 16,000 sqm. The deals mainly reflect tenants’ desire to consolidate or improve the offices they occupy. The tendency for companies to focus on higher-end office buildings and new projects on the market remains,” said Yordan Krastev, Office Space Manager at Cushman & Wakefield Forton.

Shared spaces are becoming an integral part of the office environment as they attract the attention of companies looking for flexible solutions. Year-to-date, shared office space totals 45,000 sqm and is expected to exceed 50,000 sqm by mid-2022 with the opening of MyFlex Coworking and another similar project.

Rents have remained stable for another quarter, at 15 EUR/sqm for the city center and business districts and 12-14 EUR/sqm for buildings along the main boulevards. Rising operating costs are putting pressure on landlords to increase rents, with levels in Sofia in the range of 2.75 – 4 EUR/sqm.

Retail market

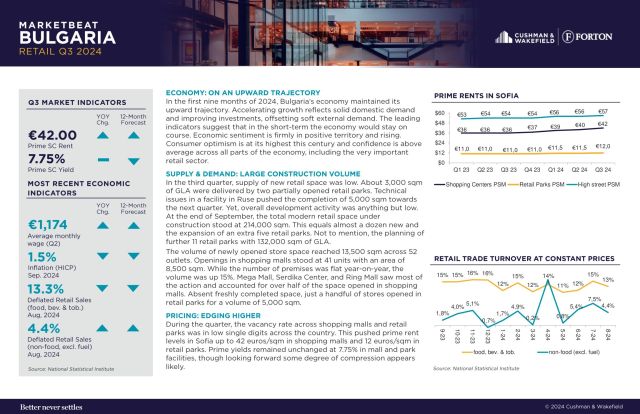

The retail market in the country is recovering from the coronavirus pandemic and is holding steady. The main focus remains on retail parks and big-box projects. The demand drivers remain FMCG, drugstores and sporting goods – these retailers continue their expansion both in Sofia and in the country. Discount chains and budget fashion brands, which have entered the market in the last few years, are also opening new stores.

The total area of retail parks sits currently at 219,000 sqm, with another 153,000 sqm under construction or in the pipeline.

“This segment of the market is developing very dynamically and there are already first signs of consolidation. Some of the major players are developing their own portfolios of projects, whereas others are moving towards acquisitions of operating projects or those under construction. Larger owners in the segment are already emerging on the market,” commented Krasimir Petrov, Manager “Retail space and asset management” at Cushman&Wakefield Forton.

With a total volume of 815,000 sqm, the shopping center segment once again remains without new projects. This trend is expected to be reversed after the announced start of construction of a new shopping center by NEPI Rockcastle fund in Plovdiv.

The lack of new shopping centers is also reflected in the relatively modest volume of new openings in Q1 2022. In the country’s largest market, Sofia, the vacancy rate remains stable at 5.6%, Cushman & Wakefield Forton reports.

Rental rates in Sofia’s shopping centers remain unchanged at 34 EUR/sqm, while in retail parks prices are rising slightly to 10 EUR/sqm/month. Rental rates in retail parks in the country remain between 7-9 EUR/sqm/month.

RELATED INSIGHTS

CAN’T FIND WHAT YOU’RE LOOKING FOR?

Get in touch with one of our professionals.